Have you noticed the recent wave of funding going to companies that are… well, not so young anymore?

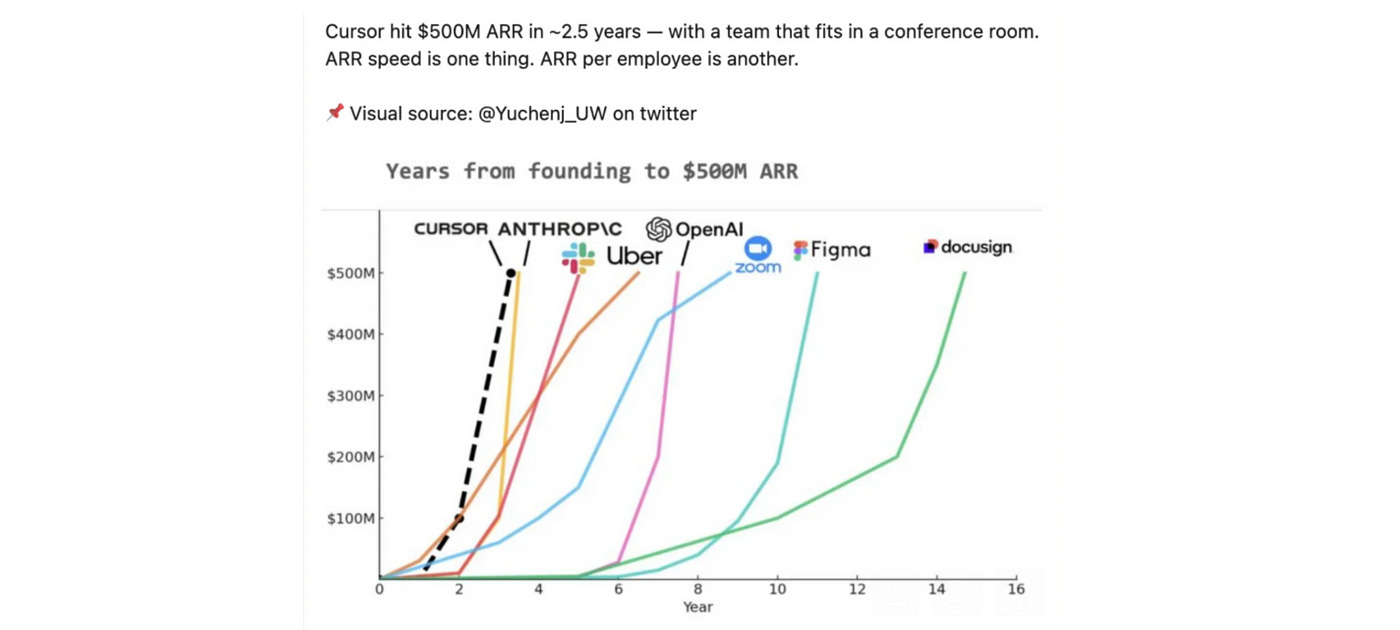

Yes, on one hand we’re witnessing startups innovating with increadible speed. Look at Cursor:

…and few other startups:

➡️ Eleven Labs: 0 to $100M ARR in 2 years with 50 people

➡️ InVideo: 0 to $61M ARR in 16 months with 80 people

➡️ Midjourney: 0 to $50M ARR in 1 year with 11 people

➡️ Mercor: 0 to $50M ARR in 2 years with 30 people

➡️ Cal AI: $21M ARR in 10 months with 2 people

➡️ bolt. new: 0 to $20M ARR in 2 months with 15 people

➡️ Lovable: 0 to $10M ARR in 2 months with 15 people

➡️ MAGNIFIC: 0 to $10M ARR in 1 year with 2 people

➡️ Aragon AI: 0 to $10M ARR in 2 years with 9 people

On the other hand, we’re seeing 10, 15, even 25+ year-old startups raising new rounds — Series B, C, or beyond. Some are even hitting unicorn status for the first time only now. The market is quite divided but it’s a refreshing reminder: not every company will blitzscale or exit in five years. Longevity, persistence, and deep infrastructure-building are finally getting their due and the fact that old-school VC funds are changing their registration types to facilitate different companies building life cycles (among other reasons) actually makes sense.

Here’s a look at some of the most interesting ‘vintage startups’ making waves lately. I’ve collected these funding updates from some of the most popular VC newsletters over the past few months.

➡️ TAE Technologies (27 years): $150M extension, now $1.3B+ raised. [Fusion energy; Google, Chevron, NEA backing]

➡️ GridPoint (22 years): $45M to optimize commercial building energy use.

➡️ Mubi (18 years): $100M at $1B post-money from Sequoia. [Independent & classic film streaming]

➡️ Infleqtion (18 years): $35M Series C for quantum systems.

➡️ XGS Energy (17 years): $13M for geothermal without water/geology dependency.

➡️ Tobin Scientific (17 years): $65M for biopharma logistics.

➡️ Amilia (16 years): $25.1M to digitize recreation centers.

➡️ Addepar (16 years): $230M Series G at $3.25B valuation.

➡️ Runwise (15 years): $30M Series B for boiler optimization tech.

➡️ HealthPlan Data Solutions (15 years): $15M for drug cost analytics.

➡️ Eyeo (14 years): $16.8M for nanophotonic image sensors.

➡️ Biolinq (13 years): $100M Series C for bloodless glucose monitoring.

➡️ Awardco (13 years): $165M Series B at $1B valuation for employee rewards.

➡️ Hellocare (13 years): $47M for remote care monitoring.

➡️ Solestial (12 years): $17M Series A for solar panels built for space.

➡️ Augur (11 years): $7M seed for preemptive cyberattack detection.

➡️FundThrough (11 years): $25M Series B for SMB invoice financing.

➡️ Canopy (11 years): $70M Series C for accounting software.

➡️ Unbound (11 years): $4M seed for GenAI enterprise deployment.

➡️ Stord (10 years): $80M Series E for cloud-based supply chain.

➡️ Capital Markets Gateway (10 years): $30M Series C to modernize ECM.

➡️ Notable Systems (10 years): $12M Series B for medical document AI.

➡️ Gravitee (10 years): $60M Series C for API data flow management.

➡️ Akido Labs (10 years): $60M Series B for clinical AI tools.

➡️ Glycomine (12 years): $115M Series C for rare disease drug.

➡️ HepaRegeniX (10 years): $24.4M for liver regeneration drug.

➡️ Manychat (10 years): $140M for marketing automation.

➡️ Aerones (10 years): $62M for robotic wind turbine maintenance.

➡️ Antheia (10 years): $56M Series C for synthetic biology pharma.

➡️ Alpaca (10 years): $52M Series C for stock/crypto trading APIs.

➡️ Instrumental (10 years): $55M to help nonprofits win grants.

➡️ Omnidian (10 years): $87M Series C for solar system performance.

➡️ Gestalt Diagnostics (10 years): $7.5M Series A for digital pathology.

➡️ Intelliseq (11 years): $4.9M for NGS data interpretation.

➡️ Quantum Systems (10 years): $181.4M Series A for defense drones.

➡️ Stash (10 years): $146M Series H for AI-powered consumer finance.

➡️ Froda (10 years): $22.6M for SMB debt financing.

➡️ EnduroSat (10 years): $48.9M for reprogrammable satellites.

➡️ X-Bow (9 years): $105M Series B for solid rocket motors.

➡️ QbDVision (9 years): $13M for digital pharma manufacturing.

➡️ Bestow (9 years): $120M Series D + $50M debt for life insurance software.

➡️ Rippling (9 years): $450M Series G at $16.8B valuation.

➡️ Replenysh (9 years): $8M Series A for recycling logistics.

➡️ Kavak (9 years): $127M equity + $400M debt for used car marketplace.

➡️ Bloom Credit (9 years): $10.5M for credit data infra.

➡️ Ocient (9 years): $42.1M B extension for massive data analysis.

➡️ Posha (9 years): $8M for AI-powered home booking assistant.

➡️ Goparity (8 years): $3.3M seed for impact investing.

Why now?🤔

Maybe we’re finally valuing real traction over velocity. Maybe capital is shifting toward resilience and proven models? Or maybe the myth of the 5-year exit is finally fading? For sure, part of the story is that the technology (including AI) can accelerate the development and startups which have been building for long can finally leverage it!

Huge respect for those who made it till now and to investors who supported them along the journey 🫡

#startups #venturecapital #resilience #deeptech #AI #funding #productmarketfit #vintagestartups #scaling #founderjourney